Historically, the last two weeks after extension season has been a slow wind-down from extension season. Wrap up the last few returns that didn’t get done by the deadline. Update workpapers that were tossed by the wayside. Catch up on emails ignored during extension season.

I started the post-tax season withdrawl similarly. I also had meetings all week long, and tried to catch-up on client work. Tax returns. Tax projections. Accounting. Write-ups on Accountable Plans and procedures and more.

Trying to do all of that as a burn down was a big mistake.

The second week I actually started over. I tackled those postit notes and got them all listed out in ClickUp. I’ve even scratched several out, scheduled a bunch, and know the rest will be there for me when I look at them again over the coming weeks. But my biggest challenge: communicating to clients why things are the way they are with deliverables.

Timing and Process

There’s been a consistent theme in my career about timing. This was especially prevalent this last year for a lot of reasons, and not all of them the Marchternity we’re still in. When will my tax return be done? What else do you need? Why isn’t my return done?

The right answer goes something like this, with maybe some more colorful language invovled:

Dear Client, Thank you for your inquiry about the state of your return. It’s not completed yet because all the people in front of you need their return done first, I have a client experiencing fraud, and several advisory clients who need a balance sheet and P&L tomorrow (and that’s what’s on the schedule). On top of this, you have only signed the engagement letter and uploaded a single W2 when I’m expecting at least three: yours, and the two from your spouse for their job-change mid-year last year, as well as 1098s, your investment information, and you haven’t completed your organizer. All this information is listed in your engagement letter.

Except the time to write that email is a good 20 minutes or more to look up the status of the project, the information I currently have (in detail), write it, double check it, add in specific thoughts for that client, and move on. And that’s 40 minutes I don’t want to loose.

I also had several clients come in for tax planning in June or July, take three weeks to sign an engagement letter, and then send me their information in September and October. If you guessed those are the tax plans I’m working on right now, you’d be right.

I really needed to get out in front of this earlier in the year. And, the last two weeks, that’s been my focus. Figuring out what to communicate and how to do so. How does one go about that.

First up, Workflows

Figma’s FigJams is my life saver here. These are easy to use whiteboards with more options than Google’s Jamboards built into them and more intuitive. You can share with your team, collaborate, and build out processes.

I went to work, and mapped out my tax prep process, admin/backend processes, and started working on my tech stack. This one I got a little stuck and distracted on. That’s okay. I’ll come back to it.

These processes really showed me what it is that I actually need to communicate to my clients. I’ve shared these with my IT Manager (slightly less fancy reality: it’s my husband), and a few really close business owner friends. Their responses? “Wow! I knew you had a bunch of things, but now I see why you’re always busy and stressed out.” Or similar. Also, “it’s like those satisfying photos of servers with really good quality cable management.”

Satisfying organization aside, mapping this out showed me what I need to automate, where I can streamline, and what I actually need to communicate.

Summarize the Return Preparation Process

If you’re a tax preparer, you already know what this looks like for you. I took the time to write it out in a spreadsheet:

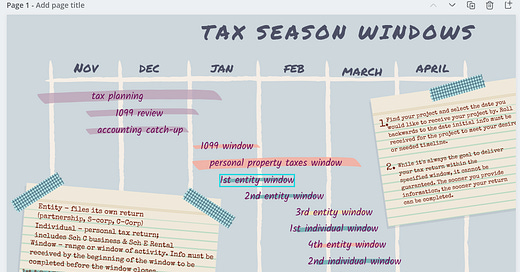

From here, I built out windows with dates based on this timing and return type. I have these for 1099s and personal property tax returns as well. And those windows became Infographic #1.

Infographics!

Everyone wants their return finished first. No one wants it last. But, even as a solo preparer who doesn’t have to manage staff schedules, there is and will always be lag time in getting things done. And communicating that to clients is difficult at best. It requires patience on both ends, and empathy from the client to understand what needs to happen.

But from another perspective, communicating this in advance sets boundaries and makes the work easy. It gives me a tool to say, “your return has been pushed to the next window,” or, “Window 1 has been extended to X date,” which is original close date plus whatever number of days I’ve decided makes sense.

I’m considering encouraging clients to sign up for a window in advance and giving each window a specific number of pre-assigned slots. It’s not a guarantee for the client or for myself. But, it is a way to set expectations and to let clients know when windows have closed for pre-season signup. I don’t know what tool I’ll use for this. Probably Cognito Forms embedded right in the email that announces this.

Links provided are not affliate links. I recieve nothing for you clicking on them. These are just links to tools I find useful.

This will be the last email with all of the content provided for free. If you’re finding value in this newsletter, show me the love with the dollars. I’ll continue to provide some information for free. In full transparency, I don’t know what that is quite yet.

Is there something you like or want to see more of? Leave a comment. Yep, those are locked to paid subscribers.

LOVE the idea of the "windows" for preparation and we are looking at doing the same. Would love to collaborate on this!!